Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Getty images

Getty imagesDuring his election campaign last year, Donald Trump promised the Americans that he would mark the beginning of a new era of prosperity.

Now, two months after his presidency, he is painting a slightly different image.

He has warned that prices will be difficult to lower and that the public should be prepared for a “small disturbance” before we can bring wealth to the United States.

Meanwhile, analysts say that the chances of a recession are increasing, pointing out their policies.

So, is Trump about to trigger a recession in the world’s largest economy?

In the United States, a recession is defined as a prolonged and widespread decrease in economic activity typically characterized by a jump in unemployment and fall in income.

A choir of economic analysts warned in recent days that the risks of this scenario are increasing.

A report by JP Morgan put the possibility of recession at 40%, compared to 30% at the beginning of the year, warning that US politics was “away from growth”, while Mark Zandi, chief economist of Moody’s Analytics, increased the probabilities from 15% to 35%, citing rates.

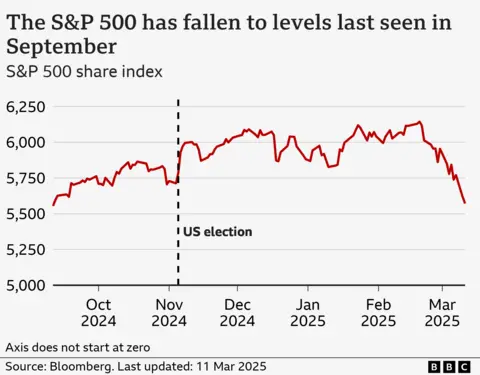

The forecasts occurred when the S&P 500, which tracks 500 of the largest companies in the United States sank abruptly. Now it has fallen to its lowest level since September in a sign of fears about the future.

Market agitation is being partly driven by concerns about new import taxes, called rates, which Trump has introduced since he assumed the position.

He has reached products from the three largest commercial partners in the United States with the new duties, and threatened them more widely in movements that analysts believe that prices and the growth of the sidewalk will increase.

Trump and his economic advisors have been warning the public that is prepared for some economic pain, while it seems to rule out The market refers: a change marked with respect to its first term, when it frequently cited the stock market as a measure of its own success.

“There will always be changes and adjustments,” he said last week, in response to companies to obtain more certainty.

The position has increased investors’ concerns about their plans.

Goldman Sachs last week increased his recession bets from 15% to 20%, saying that he saw changes in policies such as “key risk” for the economy. But he pointed out that the White House still had “the option to go back if the risks of disadvantage begin to seem more serious.”

“If the White House remained committed to its policies even to very worse data, the risk of recession would increase even more,” the firm analysts warned.

For many companies, the largest question sign are tariffs, which increase costs for US companies by putting taxes to imports. As Trump presents rates plans, many companies now face lower profit margins, while waiting for investments and hiring while trying to discover what the future will be like.

Investors are also worried about the great cuts for government workforce and government spending.

Brian Gardner, head of the Washington policy strategy at the Stifel investment bank, said companies and investors had thought that Trump intended that tariffs had tariffs as a negotiation tool.

“But what the president and his cabinet are pointing out is actually a bigger problem. It is a restructuring of the US economy,” he said. “And that is what markets has been promoting in the last two weeks.”

The American economy was already experiencing a slowdown, designed in part by the Central Bank, which has maintained the highest interest rates to try to cool the activity and stabilize prices.

In recent weeks, some data suggest faster weakening.

Retail sales fell in February, trust, which had emerged after Trump’s choice in several consumer and business surveys, has fallen, and companies, including the main airlines, retailers such as Walmart and Target, and manufacturers are warning of a setback.

Some analysts are concerned that a fall in the stock market can trigger greater repression in spending, especially among higher -income homes.

That could offer great success to the economy of the United States, which is driven by consumer spending and has become increasingly dependent on those richest homes, since low -income families face pressure from inflation.

The head of the United States Central Bank, Jerome Powell, offered guarantees in a speech last week, noting that the feeling had not been a good behavior indicator in recent years.

“Despite high levels of uncertainty, the US economy is still in a good place,” he said.

But the US economy is currently deeply linked to the rest of the world, warned Kathleen Brooks, XTB research director.

“The fact that tariffs could interrupt that at the same time there were signs that the US economy was weakening anyway … it is really promoting the fears of recession,” she says.

The restlessness in the stock market is not Trump.

Investors were already nervous about the possibility of a correction, after large profits in the last two years, driven by the strong period in advance in technological actions fed by investors optimism about artificial intelligence (AI),

The Nvidia chips manufacturer, for example, saw the price of its shares from less than $ 15 at the beginning of 2023 to almost $ 150 in November last year.

That type of promotion had caused debate about a “AI bubble”, with investors on maximum alert for the signs of exploiting, which would have a great impact on the stock market, regardless of the dynamics in the economy in general.

Now, with views on the economy of the United States, optimism about AI is becoming even more difficult to maintain.

Deepwater Asset Management’s Technological Analyst Waste Management wrote on social networks this week that his optimism had “taken a step back” as the possibility of a recession increased “meditablely” during the last month.

“The conclusion is that if we enter a recession, it will be extremely difficult for the trade to continue,” he said.