Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

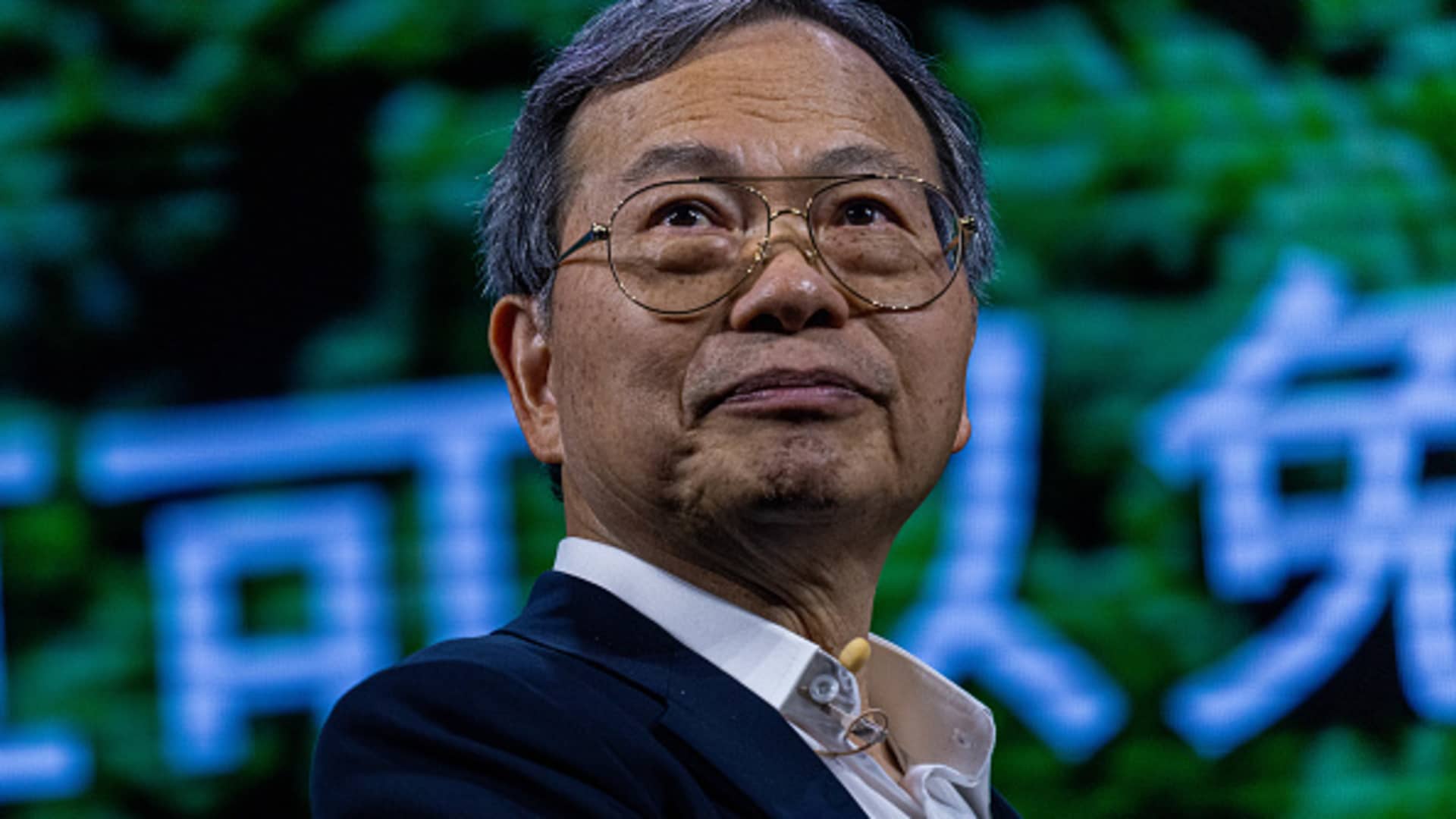

CEO of Super Micro Computer Charles Liang at the Computex Conference in Taipei, Taiwan, on June 5, 2024.

Annabelle Chih | Bloomberg | Getty images

Super micro The actions fell up to 19% on Tuesday after the server manufacturer announced preliminary results for the third fiscal quarter that were lower than analysts had projected.

This is how the company’s preliminary numbers are compared with the LSE consensus:

Super Micro lowered the ranges of the previous guide for the quarter, which ended on March 31, according to a statement. The new income range implies an 18% growth expansion, below 200% Super Micro Growth delivered a year ago.

“During the third quarter, some late decisions of the customer platform moved sales to the fourth quarter,” the company said in the statement. Super Micro said that he also saw “greater inventory reserves resulting from previous generation products.”

The company had previously requested income from $ 5 billion to $ 6 billion and profits per share of 46 cents to 62 cents. Super Micro said that his gross margin for the quarter was 220 basic points lower than the previous period.

Server competitor actions Give birth almost 5% fell into trade off hours, while Hewlett Pckard Enterprise It fell around 2%. Nvidia The shares fell approximately 2%.

Super micro actions during the past year.

The previous announcement is the last blow for Super Micro, which has been involved in controversy during the past year due to late financial presentations and worrying reports of sellers in short. In February, the company He presented his finances For its fiscal year 2024 and the first two quarters of fiscal year 2025, just in time to meet the deadline of Nasdaq to remain on the list.

Last year, after Super Micro delayed its annual report, He lost his auditorErnst & Young, citing governance problems. In November, the company appointed BDO as its new auditor.

After more than tripling in 2023, thanks to the company’s position in the AI and its sales of servers full of Nvidia processors, Super Micro Shares collapsed in the second third and fourth quarter last year, eliminating more than 80% of its market capitalization.

“We have confidence that our 2025 calendar growth could be a repetition of the 2023 calendar year, if not better, assuming that the supply chain can maintain the rhythm of demand,” said Charles Liang, CEO of Super Micro, to analysts at a telephone conference in February.

Before Tuesday’s announcement, the action increased by 18% in 2025, gathering since the broader technological market was in decline.

Super Micro will review the results with analysts at a telephone conference at 5 PM ET on Tuesday, May 6.

– Ari Levy of CNBC contributed to this report.